When a bookkeeper wants to leap to being an accountant, they will need to take the CPA exam, plus earn a bachelor’s degree (most of the time), if they do not have one already. Fifty states plus the District of Columbia require accountants to earn 150 credit hours of college education before taking the national four-part Uniform CPA exam. Rather your business is large or small, you need an understanding of your accounting needs. As a business leader, you should have a good idea of which professionals best suit the needs of your company.

Common bookkeeper duties

Bookkeepers don’t need a special certification, but a good bookkeeper is important for an accountant to have accurate financial records. The double-entry system of bookkeeping is common in accounting software programs like QuickBooks. With this method, bookkeepers record transactions under expense or income.

Bookkeeper Job Description

- Bookkeeping is the daily financial tracking of all of your daily financial transactions.

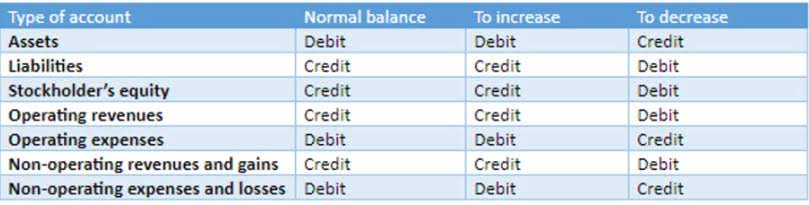

- The advent of accounting software significantly lessened the tediousness of bookkeeping by handling debits and credits for you in the background.

- Our expert CPAs and QuickBooks ProAdvisors average 15 years of experience working with small businesses across various industries.

- If they notice expenses are going over budget or under budget, they can look into what’s causing this discrepancy and make recommendations to resolve these problems.

- The distinctions between accounting and bookkeeping are subtle yet essential.

- Next, set aside a dedicated time either weekly or biweekly to review your bookkeeping, reconcile transactions and complete necessary data entry.

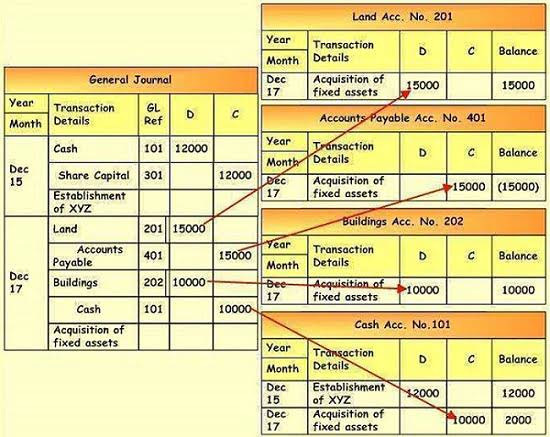

Companies often outsource the organization of their finances to independent professionals, then hire accountants for more complex issues and tax filing. A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event bookkeeper meaning changes at least two different ledger accounts. After a certain period, typically a month, each column in each journal is totalled to give a summary for that period. Using the rules of double-entry, these journal summaries are then transferred to their respective accounts in the ledger, or account book.

What is bookkeeping?

As a bookkeeper, your attention to detail must be almost preternatural. Careless mistakes that seem inconsequential at the time can lead to bigger, costlier, more time-consuming problems down the road. Rarely does a bookkeeper work on one big project for an eight-hour shift; instead, a typical workday involves juggling five or six smaller jobs. Nearly all bookkeeping is done using computerized accounting software and programs, so bookkeepers should be comfortable learning new technology if not proficient in it. Much of the work that goes into bookkeeping is more administrative than anything else.

- Data entry can now happen as soon as you snap a photo of a receipt with your smartphone.

- Bookkeepers need a strong grasp of all financial details in the company so they know if there are any inconsistencies.

- Online bookkeeping services might be the exact solution you need to save both time and money.

- Both accountants and bookkeepers work to maintain accurate records of finances, and sometimes the terms are used interchangeably.

- Mid-size and small public accounting firms pay, on average, about 10% less than these firms.

Bookkeepers are integral to ensuring that businesses keep their finances organized. If you’re interested in a career as a bookkeeper, consider taking a cost-effective, flexible course through Coursera. At the end of the course, you’ll receive a professional certificate, which you can put on your resume to demonstrate your skills and accomplishments to potential employers. Typically, single entry bookkeeping is suitable for keeping track of cash, taxable income, and tax deductible expenses.

- The directors of a company are able to make corporate decisions based on the data they receive from an accountant.

- The most important parts of doing your own bookkeeping are staying organized and keeping track of the details.

- They monitor cash flow and produce financial reports to assist managers in taking strategic decisions.

- Their work plays an important role in the operation of a successful business, which can have very many transactions in a single day, let alone a week, month, fiscal quarter, or year.

How your business operates is unique, and your bookkeeping follows suit. They can also usually take care of some of the tax preparation so that your accountant has less to do (which is a good thing, because bookkeepers are less expensive than a CPA). But they won’t be able to help you with tax planning or handling your tax return. The bookkeeper should be able to answer all questions about daily finances and the status of payments. Bookkeepers need a strong grasp of all financial details in the company so they know if there are any inconsistencies. Bookkeeping is a great starting point if you are interested in the field but not fully committed and want to test the waters.

A (very) brief history of bookkeepers

My suggestion is to first read our free 13-part Bookkeeping Explanation and take our Bookkeeping Practice Quiz. Next, you can start studying each of the bookkeeping-related topics found on our Bookkeeping training page. Take our free career test to find out if bookkeeper is one of your top career matches.

That’s why it’s so important to understand the nuances between bookkeeping and accounting. Both of these aspects of your business are crucial for financial management and decision-making. Today, we’ll go over the differences between bookkeeping and accounting so that you can figure out how to allocate resources effectively. However, bookkeeping and accounting clerk jobs are expected to decline, with the BLS projecting a 5% fall in jobs over the same period.

They may also assist with payroll processing, budgeting, and maintaining financial records in accordance with established accounting principles and procedures. A bookkeeper is responsible for recording daily financial transactions, updating a general ledger and preparing trial balances for perusal by accountants. They monitor cash flow and produce financial reports to assist managers in taking strategic decisions.

The Accrual vs Cash Basis of Accounting

Bookkeepers often get paid hourly wages rather than annual salaries. The average wage for someone new to the business is $21.70 per hour. This is the equivalent of around $45,000 per year, assuming a 40-hour workweek. The advantage of hourly pay is you receive 1.5 times your average wage for hours worked more than 40 per week.